These terms last a couple of days to a year, and the longer the debt is outstanding, the more difficult it becomes to collect.

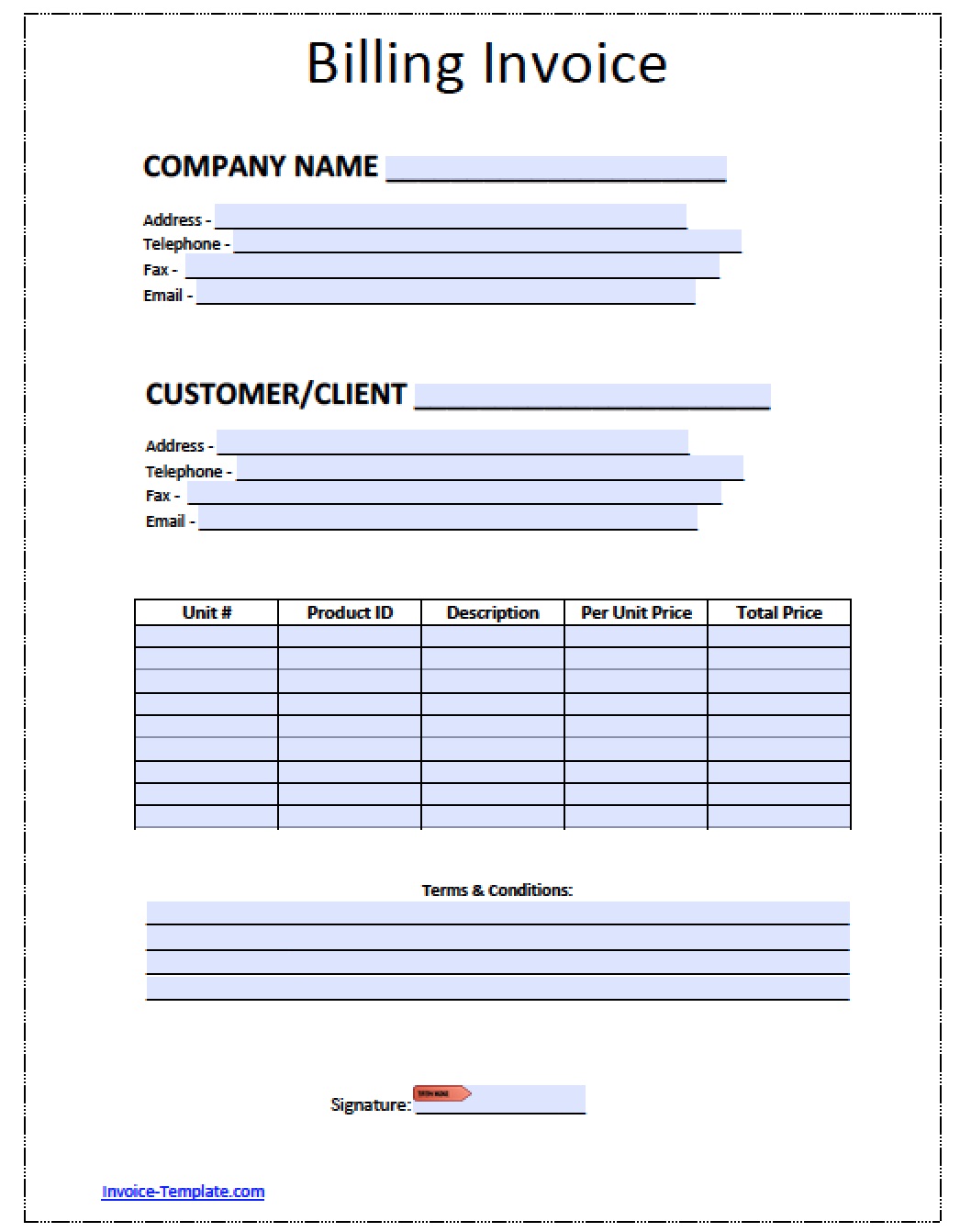

It also lets you know when you rely too much on credit or overspending with vendors.Īccounts receivable are hard to track because you rely on the other party to commit to their dues. You have control over when you pay the due amount to other vendors. Employers who don't know the principles of accounts receivable and accounts payable leave themselves open to bad deals and a lack of budget planning.Īccounts payable are more trackable than accounts receivable. Poor cash management is the leading factor for many failed businesses. Not only will you keep a better track of the company's money, but you can also prevent unexpected expenses. If accounts receivable is the money customers owe you for goods and services, then accounts payable is the money you owe to vendors and suppliers.īoth of these concepts are important to the health of your business. Knowing this gives you an understanding of the company's profitability and the overall income coming into the business. This process gives you a clear view of your financial standing and helps you make potential changes to your business model. In accounting terms, it's the money you receive from customers after selling goods or services. It controls the cash flow of your business and notifies you of unpaid invoices.

If your company handles a list of clients, it becomes easy to lose track of payments and how much they owe you.Īccounts receivable management help in this regard. With this knowledge, your business has a chance to succeed. This article will inform you about the basics of accounts receivable management, why you need to know it, and what to expect from the process. This process plays an active role in the accounting cycle benefiting the accountant and the client.įor any good business, accounts receivables need constant monitoring to manage the cash flow and keep a careful eye on the money. New accountants or business owner needs to know the basics of accounts receivable.

0 kommentar(er)

0 kommentar(er)